Enterprise AI Integration.

Efficient. Scalable. Autonomous.

Integrating enterprise AI systems while helping you navigate technological, security, ethical and regulatory challenges.

MISSION: INTELLIGENT INFRASTRUCTURE

Ivan Honis, Founder

Recent: AI & Fintech Projects

BrainBuzzy.com

Kognitív ötletgenerátor platform. 33 tudományos keretrendszert és AI-t alkalmaz a kreatív blokkok feloldására.

View Project →

MySQL RAG Engine

Semantic search layer directly over MySQL databases tailored for legacy integrity.

View Project →

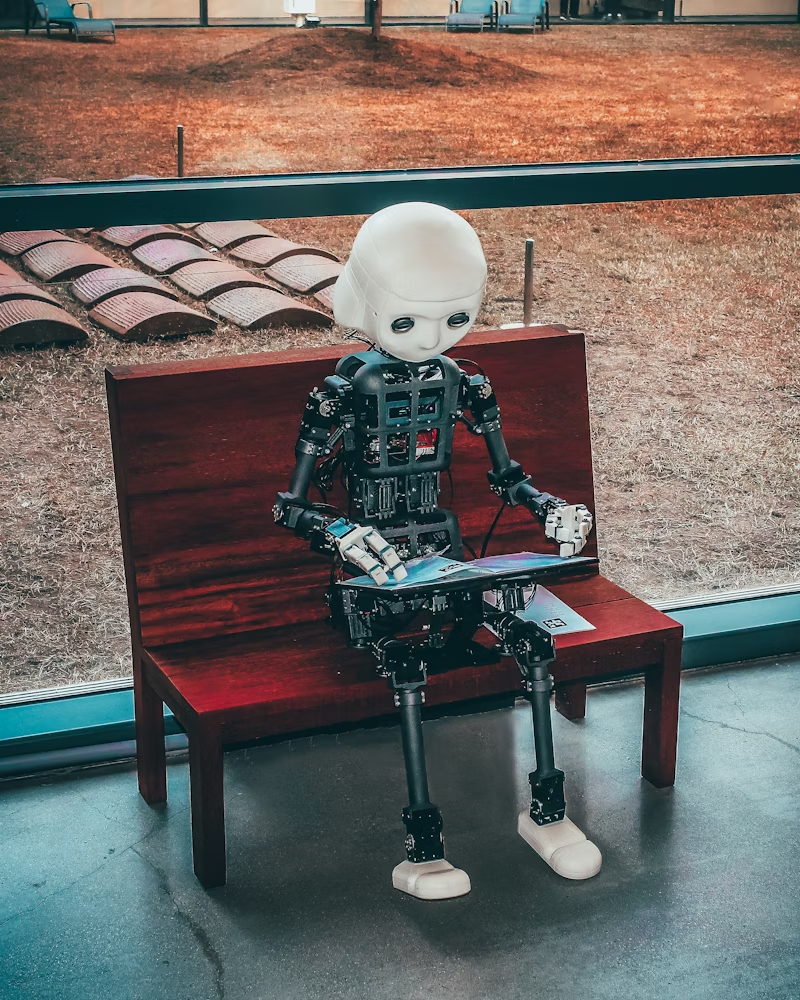

AI_HOME

Cognitive research framework exploring autonomous AI identity formation.

View Project →

D&B Library

Developer library generating functional code autonomously.

View Project →

Qoowee.com

Platform for ultra-specialized, domain-specific AI "micro-experts".

View Project →Enterprise & Trading Solutions

Enterprise AI Integration

Custom AI Solutions Development

- Tailored artificial intelligence applications designed specifically to meet enterprise needs.

- Development of data-driven predictive models for business decision support.

- Creation and optimization of machine learning and deep learning systems.

- Implementation of scalable AI applications within existing infrastructure.

Enterprise AI System Integration

- Seamless integration of AI-based solutions with ERP, CRM, and BI systems.

- Solving compatibility issues and developing effective system-integration strategies.

- Ensuring compliance with data protection and security requirements during AI integration.

- Enhancing existing enterprise infrastructure to support AI compatibility.

AI-Driven Automation and Efficiency

- Intelligent automation of business processes using machine learning.

- Robotic automation (RPA) to replace repetitive tasks and workflows.

- Application of predictive analytics for process optimization and cost reduction.

- Introduction of AI-powered decision support systems.

AI Consulting and Training

- Strategic consulting for successful corporate adoption of artificial intelligence.

- Executive training sessions and workshops on effective AI utilization.

- AI-awareness programs tailored for employee education.

- Professional support and consultations for AI project management.

Specialized Services for Financial Institutions

Development of Algorithmic Strategies

- Strategy Development: Designing trading strategies tailored to client needs (e.g., arbitrage, trend-following)

- Backtesting: Testing strategies on historical data

- Optimization: Fine-tuning parameters for optimal performance

- Portfolio Integration: Running a given strategy within a portfolio

API Integrations and Technical Solutions

- API Integration with Brokerage Platforms: Integrating trading bots or client-specific tools

- Data Processing: Handling market feeds, processing, and analyzing real-time data

- Debugging and Maintenance: Supporting and improving existing systems

Data Services

- Market Data Analysis: Providing real-time and historical data to support trading decisions

- Sentiment Analysis: Analyzing news, social media, and other sources for algorithmic strategies

- Volatility Forecasting: Supporting risk management and trading strategies

Risk Management Solutions

- Portfolio Risk Analysis: Developing automated risk management tools

- Stop-Loss, Hedging, and Trailer Algorithms: Customizable risk mitigation solutions

- Stress Tests and Simulations: Examining strategy behavior in various market conditions

Maintenance of Automated Trading Systems

- Full System Management: Developing, operating, and updating automated trading systems

- Ensuring Scalability: Optimizing system performance for parallel processing and multi-processor execution

- Monitoring and Reporting: Real-time observation and performance analysis

HFT (High-Frequency Trading) Infrastructure

- Low-Latency Systems: Optimizing trading systems for minimal latency

- Cython/C Implementation: Ensuring high-performance computations

- Real-Time Visualization: Interactive and live data displays

Compliance and Regulatory Solutions

- Automated Regulatory Reporting: Collecting data and generating reports in compliance with regulations

- Strategy Compliance Auditing: Developing audit algorithms to ensure regulatory compliance

White-Label Solutions

- Pre-Built Systems: Customizable trading platforms for brokers to use under their own brand

- Signal Services: Providing automated trading signals

Featured Projects

RlTaTuning

AI-powered reinforcement learning tool for optimizing technical analysis parameters in stock market trading strategies. Automatically identifies optimal indicator settings to enhance trading accuracy and profitability.

BinanceFastCorrection

Automated system that detects rapid market corrections on Binance and executes responsive trades. Designed to quickly capitalize on sudden price movements or minimize potential losses.

breakout_strategy

AI-based system for accurately detecting and trading market breakouts. Identifies key price levels and signals when the market breaks beyond established trading ranges.

nDot_AcReA

Market trading strategy focusing on capturing profitable action-reaction price movements. Analyzes price action patterns to anticipate and profit from short-term market reversals.

nDot_crypto_db

Cryptocurrency market data collection and database management tool. Provides structured storage and easy retrieval of historical crypto market data for analysis and backtesting.

nDot

Research and strategy-building tool utilizing AI to develop advanced market trading strategies. Allows traders to experiment, optimize, and validate AI-driven strategies across various market conditions.

ndot_trade_server

Backend trade execution server specifically designed for strategies developed with the nDot AI tool. Facilitates rapid and reliable execution of trades generated by AI strategies.

Algorithmic Strategy Research

PreMarket Estimator

I focus on stocks that are expected to show significant price movements (gaps) during the premarket, usually due to news or earnings reports. I record the highest price formed during the premarket, and if the price exceeds this level after the market opens, I go LONG. Based on my experience, it’s advisable to exit after a few percentage points of increase, as the premarket boom often corrects itself.

EMA SHIFT & PARALLEL

This strategy was developed for CRYPTO FUTURES – ETHUSDT.P. I aimed for the strategy to function in a live environment, so I focused on making its operation realistic. Modified a simple, well-known method: the crossover of two exponential moving averages (FAST, SLOW) generates the entry and exit signals.